In an unexpected agricultural twist, the Nashik Onion Boom has taken center stage in 2025. A staggering 63% increase in summer onion yield has stunned policymakers, empowered farmers, and stirred the national agri-market. However, this agricultural windfall is a double-edged sword. While farmers celebrate record-breaking productivity, many still grapple with pricing instability, storage crises, and long-term sustainability.

This blog dives into the 7 shocking successes that made this boom possible and the lingering fears that continue to haunt Nashik’s onion farmers even in this victorious season.

Read More About Nashik Onion Market

1. Record-Breaking Yield: The 63% Surge Explained

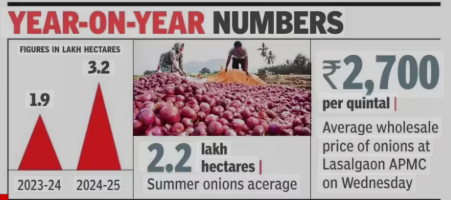

The Nashik Onion Boom began with a nearly 5 lakh quintal harvest in just the summer season of 2024–25. Agricultural experts attribute this unprecedented growth to:

- Widespread adoption of disease-resistant hybrid seeds

- Enhanced irrigation systems, especially drip irrigation

- Stable climatic conditions during germination and bulb formation

- Aggressive awareness campaigns by the agriculture department

Yet, as impressive as this number is, farmers fear that excess yield may trigger gluts in the market, forcing prices to plummet leaving them with more onions, but less profit.

2. Better Input Management: A Success Rooted in Precision

Behind the Nashik Onion Boom is a significant shift toward precision farming. Farmers now use:

- Soil health cards to determine exact nutrient needs

- Timely application of micronutrients and bio-fertilizers

- Use of GPS mapping tools for field planning

This scientific approach has reduced waste and improved crop resilience, but it’s not without concern. Input costs for technology have risen, leaving small farmers reliant on government subsidies and loans, which are often delayed or insufficient.

3. Government Schemes: Support with Strings Attached

The boom wouldn’t have been possible without government intervention. Schemes like:

- Onion Development Program (ODP)

- PM-Kisan Samman Nidhi

- Crop Insurance under PMFBY

played a key role. However, only 42% of eligible farmers reportedly received timely financial disbursement in Nashik. Corruption, red tape, and lack of digital literacy remain serious challenges. Many farmers involved in the Nashik Onion Boom still fear being left out of critical policy benefits.

4. Improved Logistics & Mandis: Success with a Price

The Lasalgaon Mandi, India’s largest onion market, has seen infrastructure upgrades—more auction sheds, cold storage links, and digital bidding portals. These steps ensured that Nashik’s massive yield could be quickly and safely transported across India.

However, truckers are now demanding higher freight charges due to fuel costs and longer queues. In peak harvest weeks, transport availability shrinks, leaving farmers with rotting stock and no buyer in sight.

The success of the Nashik Onion Boom in reaching distant states like Delhi and Kolkata now hinges on whether logistical systems can keep up with the crop’s pace.

5. Storage Woes: The Boom’s Most Painful Reality

Perhaps the biggest threat to the Nashik Onion Boom is the shortage of scientific storage units. Less than 35% of harvested onions are kept in ventilated storage facilities. Most are piled under tin sheds, vulnerable to:

- Monsoon spoilage

- Rodents and fungal rot

- Weight loss due to dehydration

While the 63% yield surge is a reason to rejoice, post-harvest losses may wipe out up to 25% of earnings if storage isn’t expanded. Farmers urge the state government to fast-track the ₹300 crore cold storage fund, but action has been slow

6. Market Price Volatility: Rich in Crop, Poor in Profit

Despite the bumper harvest, farm-gate prices fell by 18–25% compared to last year. In some Nashik villages, onions sold for as low as ₹5–7 per kg far below the breakeven price of ₹10/kg.

This contradiction lies at the heart of the Nashik Onion Boom: more onions don’t mean more income. Market saturation, lack of MSP enforcement, and exploitative middlemen leave farmers in the lurch.

Many now question: What good is a bumper yield if it brings financial ruin?

7. Global Export Prospects: A Hopeful Horizon with Risks

One of the most promising aspects of the Nashik Onion Boom is the revival of exports. With international demand rising in Sri Lanka, Bangladesh, and the Middle East, Nashik’s onions are poised to make a global mark.

In April–May 2025, Nashik recorded a 30% increase in onion export volume, thanks to:

- Competitive pricing due to surplus

- Improved packaging standards

- Streamlined port logistics via Nhava Sheva

However, India’s export ban history casts a long shadow. A single policy reversal could crash overseas deals overnight, making export-oriented farmers vulnerable again.

Data Snapshot: Nashik Onion Boom at a Glance

| Indicator | 2023–24 | 2024–25 | Change |

|---|---|---|---|

| Yield (quintals) | 3.03 lakh | 4.95 lakh | +63% |

| Avg. Market Price (₹/kg) | ₹12.80 | ₹9.40 | -26.5% |

| Storage Capacity (scientific) | 2.1 lakh quintal | 2.5 lakh quintal | +19% |

| Export Volume (tonnes) | 1,800 | 2,350 | +30.5% |

| Farmer Benefit Disbursement Rate | 62% | 42% | -20% |

FAQs About the Nashik Onion Boom

Q1. Why is Nashik the leader in onion production in India?

Nashik’s well-drained black soil, favorable climate, and established mandi network make it ideal for onion farming.

Q2. What caused the 63% increase in yield this year?

Better seeds, scientific input methods, and timely rainfall contributed to the growth.

Q3. Are farmers earning more due to the Nashik Onion Boom?

Not necessarily. Market prices fell due to oversupply, cutting into profits despite higher yields.

Q4. Will the government fix low onion prices?

There's demand for a Minimum Support Price (MSP) for onions, but implementation remains pending.

Q5. Can exports save the onion market?

Possibly, but inconsistent export policies and international competition are big risks.

Final Thoughts: The Dual Face of the Nashik Onion Boom

The Nashik Onion Boom is both a triumph of modern agriculture and a cautionary tale. It showcases what’s possible when technology, government policy, and farmer effort align but also exposes the fragility of agri-economies when systems fail to support the last mile.

The 63% yield surge proves Nashik’s potential as India’s onion capital, but for the boom to be sustainable and profitable, deeper reforms are needed in:

- Market pricing policies

- Storage infrastructure

- Export regulation

- Farmer education and digitization

Until then, the Nashik Onion Boom will remain a season of success shadowed by struggle.

Pingback: Nashik Seaplane Service: 7 Stunning Pros and Serious Cons